Our Solutions

Working with Banks, Retailers, Insurers, Telcos and various State-Owned Enterprises for over 20 years, we have identified that greater than 80% of these organisations historically had a side desk or siloed approach to fraud risk management. This resulted in overlapping and reactive controls creating complexities over time, emboldening the cross-industry fraud crime rings whilst hurting the cost of operations and customer experience.

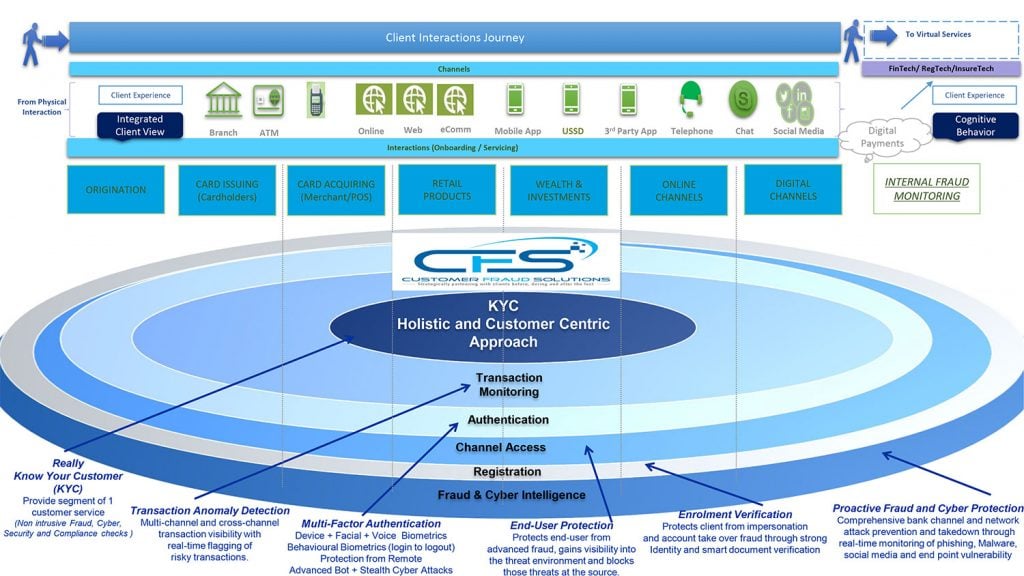

Customer Fraud Solutions takes a holistic and customer centric approach to fraud risk management, providing for enterprise wide synergies, a single view of the customer, preferences and the risks thereof. Customer Fraud Solutions further provides clients with actionable insight to reduce operational burden and customer friction, and doing so, we manage business risk responsibly, non-intrusively and without bypassing vital fraud and security controls.

We consult by first understanding and appreciating your business through an independent, expert and unbiased Fraud Business Review. Thereafter, we will benchmark your organisations fraud resource capability to local and global competitors and then map out a commercially pragmatic roadmap, starting with quick win deliverables whilst building out strategic capability that will leverage on existing and new investments to maximise cost efficiencies and ROI.

The fraud review terms of reference and project charter will clearly articulate your business requirements, scope, success criteria and constraints. This will be coupled with an as-is status quo gap analysis and a future-proof capability blueprint that will assist you realise your business vision.

Equally, we work alongside side you to execute on the recommendations and strategic blueprint to realise the desired business outcomes and value.